The cost of living in America

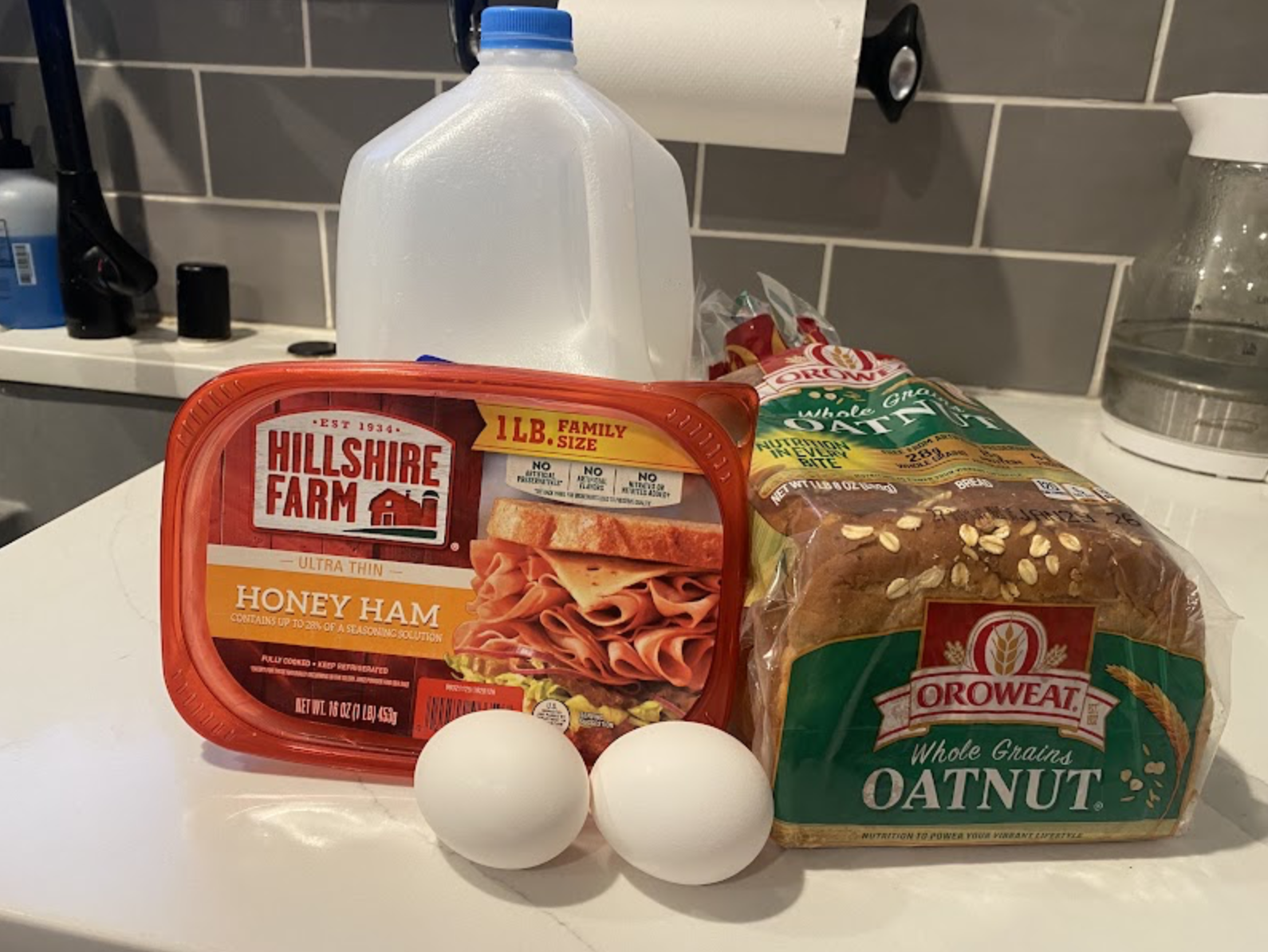

Inflation has greatly increased grocery prices (Bella Guerrero / The Puma Prensa)

By Bella Guerrero, Staff Writer

If you went to a McDonald's in 1960 and you only had a dollar on hand, you could get a burger, fries, and soda for about ninety cents and still have an extra ten cents leftover. As of 2025, this same meal costs around five to six dollars; why does this happen, and what contributes to it?

Inflation is the gradual increasein the prices of goods and services, resulting in price increases and a decrease in the value of our money. Inflation is caused by factors such as consumer demand, high production costs, and fiscal policies. The rising prices of everyday necessities and services are making it that much more challenging to be able to afford things in America, and it becomes even more of a problem when the wages of working Americans are not keeping up with the rate at which these prices are increasing.

In 1970, the average sales price for a house in America was $27,000, whereas the average cost today is $512,800 according to the Federal Reserve Bank of St Louis, nearly nineteen times the amount it was 56 years ago. The median cost of a house in Sonoma County alone is $800,000 according to Redfin. The average cost of a house in America has increased by over 120 percent since the 1960s, making it nearly impossible for the new generation of home buyers to be able to afford housing on their own.

Many Gen Z adults are afraid that they will never be able to afford a house in their lifetime due to these high costs. On top of this, college students are also going into financial debt, struggling to pay off their tuition and student loans.

Going to a public college in this day and age is so much more expensive for Gen Z (1997-2012) than it would have been for Gen X (1965-1980). According to the Education Data Initiative, tuition costs for Gen X ranged anywhere from $256 to $1,031; this price has drastically jumped to 10,340 dollars as of 2025. The cost to attend college has surpassed the rate of inflation, inflating 41.7% faster than the current rate of inflation. This means that while the rate of inflation is 2.7%, the inflation rate for college tuition is about 3.91%. Not to mention that if you intend on going to college, you will likely also need to pay for gas, groceries, toiletries, and a dormitory, which costs an additional $11,000 to $13,000 a year.

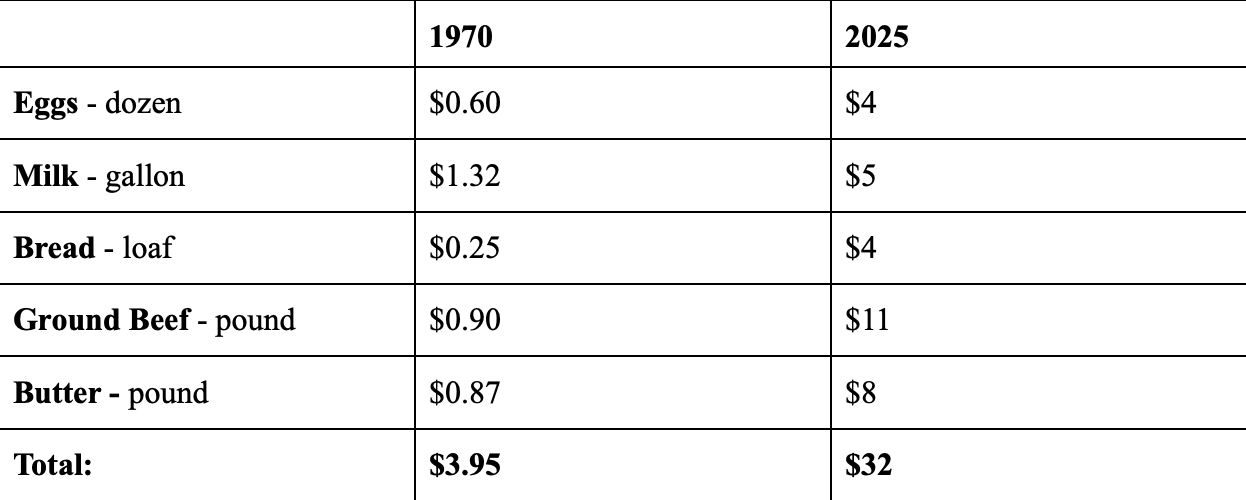

Grocery prices have also greatly increased since the 1970s, making purchasing the ingredients for just a few dinners cost an egregious amount of money. A few simple ingredients like eggs, butter, milk, ground beef, and bread can cost you over thirty dollars, whereas in 1970, you could purchase the same ingredients for just under four dollars.

Grocery prices in 1970 vs 2025

Such high costs for groceries make it difficult to prepare healthy and nutritious meals because of increased prices on whole foods like meats, fruits, and vegetables. The United States Department of Agriculture (USDA) says that about 13.5% of American households in 2023 struggled with food insecurity, meaning that roughly eighteen million families in the U.S. were unable to afford food because of poverty or lack of resources like federal food assistance programs or access to a community food pantry. If the cost of groceries keeps increasing, even more households will likely become food insecure.

How can Americans be expected to function in a country where we can barely afford to survive on our own? Inflation keeps making everything so much more expensive, and minimum wage is not increasing enough for the average U.S. citizen to be able to afford a comfortable life without financial stress. These increasing numbers and lack of affordability will make the cost of living in America a nightmare.